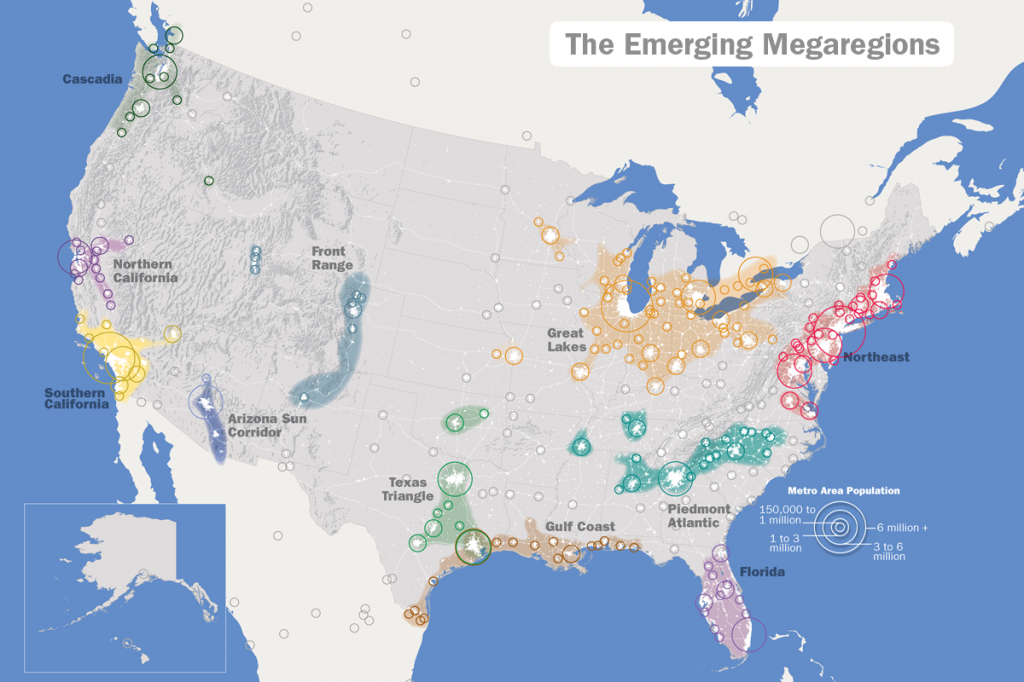

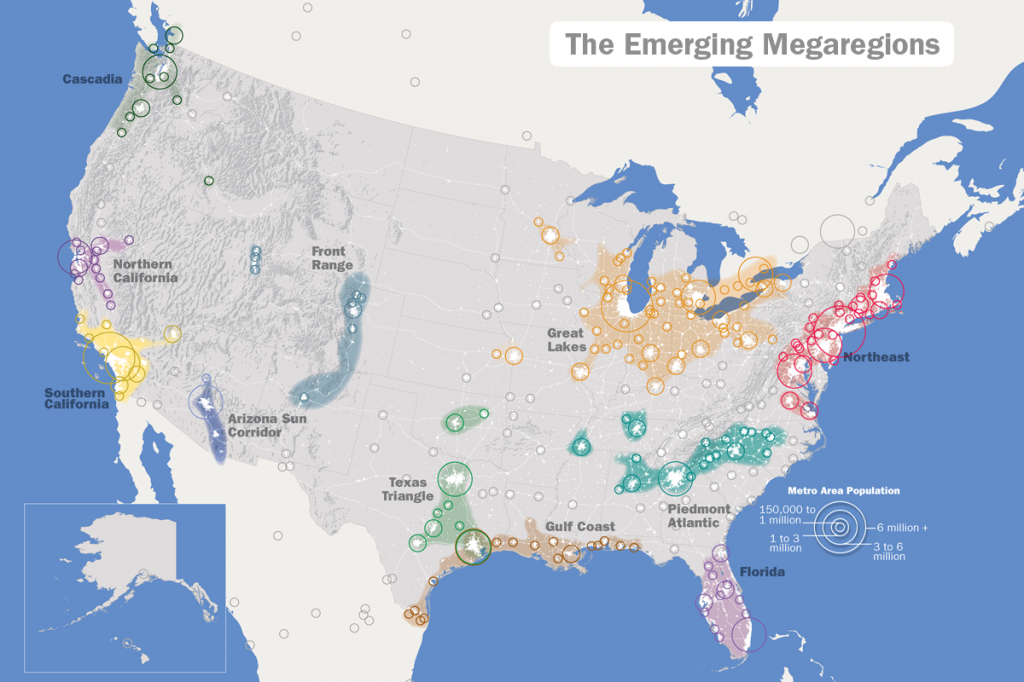

I was invited to the New England Regional Smart Growth Conference last week – hosted by the Lincoln Institute at the Federal Reserve of Boston. I follow the Institute because I’ve always been a land planning geek. Your twitterers can follow them at (@landpolicy). The conf is a great way to get together with a few people (a couple hundred this year) who work on various issues related to urban growth in New England. They always have great presentations as well. I met a woman who runs stormwater programs for the state of Connecticut, a programmer at ICLEI (USA) – the international org born in Rio’92, charged with supporting the implementation of Agenda 21 – which is a checklist for communities to use to approach a sustainable future. I ran into a cooperative colleague, Orion Kriegman, who is based at the Institute for Policy Studies, but is working on “Pueblo Boston” a creative urban land trust / cooperative concept in Eggleston Square JP/Roxbury. Always good to network with planning types. Armando Carbonell, of the Lincoln Institute, led off with a great tour of work they are doing – in regional planning, high-speed rail, and land tax policy. He looked at nature in cities, and cities in nature. He commented that the future of human populations is in cities – and cities that are becoming less and less dense than ever before, and what the implications of this will be… I was reminded of reading about America’s Megaregions when I ploughed through the Plan of Nashville last summer – a great document of helping focus growth in a great city. Philip Langdon at the New Urban Network wrote a good write-up and described the issues with the federal de-funding of the Sustainable Community Initiatives program.

Armando Carbonell, of the Lincoln Institute, led off with a great tour of work they are doing – in regional planning, high-speed rail, and land tax policy. He looked at nature in cities, and cities in nature. He commented that the future of human populations is in cities – and cities that are becoming less and less dense than ever before, and what the implications of this will be… I was reminded of reading about America’s Megaregions when I ploughed through the Plan of Nashville last summer – a great document of helping focus growth in a great city. Philip Langdon at the New Urban Network wrote a good write-up and described the issues with the federal de-funding of the Sustainable Community Initiatives program.

Another excellent presenter was Lyle Wray from Hartford CT (though his name and accent places his provenance further south) who is working on enhancing the presence of the Knowledge Corridor – which I would call the Connecticut River Valley or Pioneer Valley – basically Hartford to Greenfield MA. There are 1.9M in the region and it is basically in the top 20 regions, population-wise, of the country, but spread out across Hartford, Springfield/Holyoke, and Amherst/Northampton. Lyle’s big statement was that we planners, if we all take a Myers-Briggs test, will notice that we all enjoy thinking about things systemically and in holistic ways. But 95% of the population does not like to think this way. We have to figure out how to present the solutions we advocate in ways that use the non-systems language of the majority of the population. Food for thought.

The best presentation of the day was from the keynote speaker, Ron Sims – former Deputy Secretary for HUD and former King County (Seattle Washington) Executive. “Sustainability is the way of the future. If you are conservative, you will believe in sustainability” “It is using money smartly and conservatively” “Poor planning is a signal to your business community that you are going to treat them as the ATM for public projects.” “Density improves communities: people living together tightly forces them to figure it out, figure it out how to live well with one another. We all need to do this.” And he urged us to share prosperity across all segments of our communities – it’s not enough to just let some people live in the poor part of town. We need “all hands on deck” to innovate, and solve problems, if we are going to survive. “We can’t compete with China and India based just on the bell curve” and we’ll need everyone’s contribution. He brought up his story about climbing Mt. Ranier – in a rope team – you can only go as fast and as far as the slowest and weakest on the rope team. We are all in it together.

It was a great talk, but not just about planning. Ron talked about motivation. Why go to work in the morning if it is going to be easy? He also talked about managment. He wanted people to take risks. If you take a risk, and you win, I will sing your praises. If you take a risk and fail, I will help you get better. If you do not take any risks while you are working for me, I will make it very hard for you to work here. Chuckles ensued from the crowd. I enjoyed his exhortation to embrace the cause. Sustainability is wonderful because it is not just a practice, or a discipline, it is a cause that we can commit our passion to. It is a community. We are lucky to be doing this work. And I totally agree with him.

photo from:

photo from: